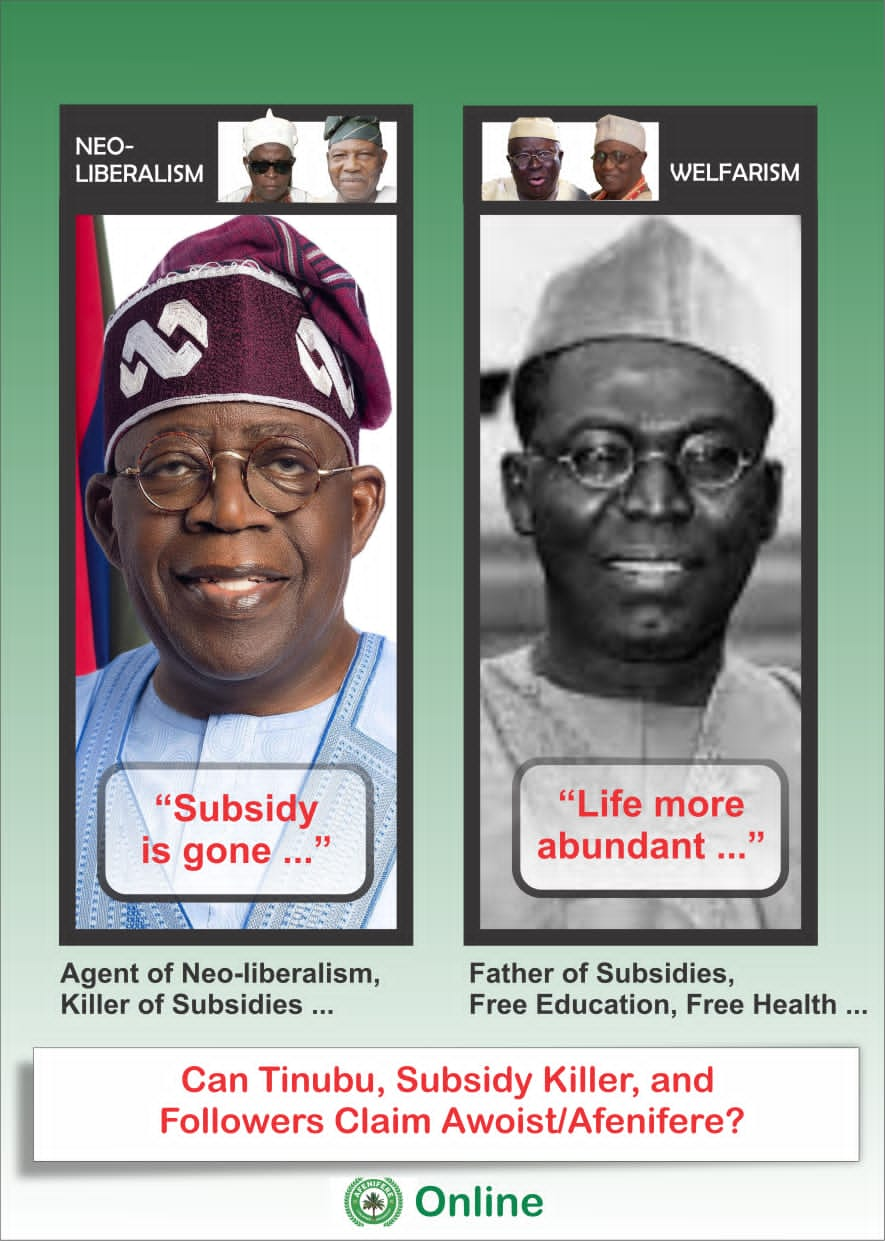

The CBN announcement of a drastic increase in interest rates to curb inflation completes the trajectory of outpricing life in Nigeria, instead of its duty to make life more abundant. Yorubas will say ‘afi bi afise’, its like being cursed, when on the first day in office, President Tinubu removed fuel subsidies, then pushed Naira out of the window to float, then increased school fees, then increased import duties, electricity tariffs, and now increasing price of money.

In Nollywood movies when medical doctors can’t cure a patient, they advise his family to ‘te ese Ile bo’ meaning to seek home remedies of traditional spiritual cures. Unfortunately, being a multicultural nation, Economists can’t pass the illogicality of the Nigerian economic situation to a specific traditional cure or we might be accused of cultural favoritism, so we can only advice universal psychoanalysis of why Tinubu is bent on self destructive policies to outprice life.

The current hyper-inflation is the result of illogical floating Naira without a predetermined lower limit, thereby allowing a free fall of Naira, in a country with over 70% of raw materials and 90% of our durable goods are imported. The free fall in Naira is obviously not due to transactional demand but speculative demand, so the rise in interest rates can only reduce speculative demand if the rates rise to a point that speculators can make more money saving than speculating on the Naira value, and such high rates will outprice and kill all productive busineses. On the supply side, why did the government stop funding the forex market, when we have $30 billion cash inherited from the Buhari government, and where are new funds from NNPC?

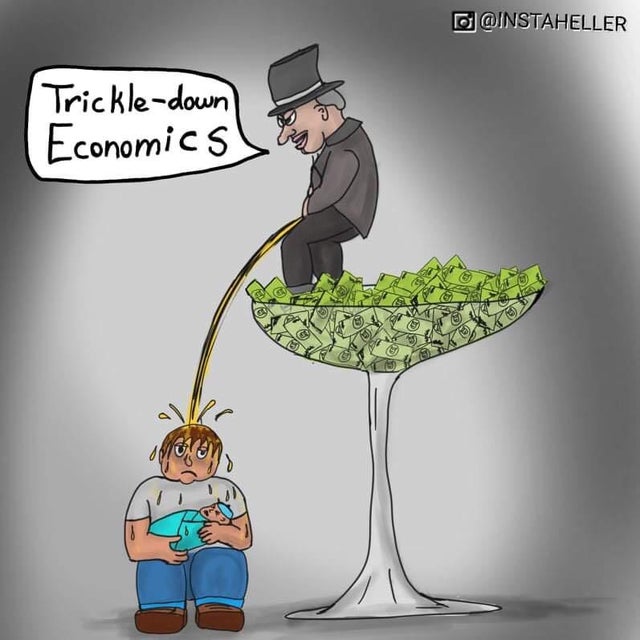

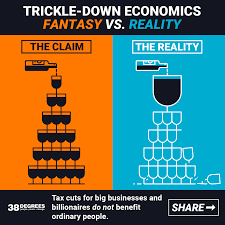

How can you float the Naira knowing that speculators will have a field day destroying its value, then when the resultant inflation appears, you punish non-speculative real producers by increasing interest rates. Where is the excess liquidity to mop up in an economy that suffered a cash crunch due to currency change for most of 2023. A few days ago Wale Edun, the Finance Minister and Coordinating Minister of the Economy, stated that approximately only 5% of people in Nigeria have more than N500,000 (less than $400) in their bank accounts, so why would the government increase interest rates to permanently keep 95% of the population in the poverty trap? Fiscal and not monetary policies are required.

According to the International Energy Agency, the global average of fuel subsides to national GDP is about 7.1% while ours ($10 billion) was just over 2% of our $480 billion GDP. Despite $30 billion cash reserves, you stop the $10 billion subsidies that contributes at least $20 billion in multiplier effects across the economy, and in doing so provoke a recession predicted to last for four years, as we won’t witness 2% GDP growth till 2028 as we suffer 44% cost push inflation. The rational thing to do was to pay the $10 billion for a year, while refineries were put in place for cheaper fuel.

Yet, Tinubu continues to promise light at the end of the tunnel by removing money from the markets and outprice production. How can one remove fuel subsidies that has huge multiplier effects in our economy that is dominated by small and medium sized enterprises, who depend on fuel for production? How can making energy (fuel and electricity) more expensive make people use more energy to increase their economic productivity? How will making loans more scarce and expensive spur local investment into the productive sector?

When it is obvious that the Dollar is overvalued due to speculative demand, why would government adjust the custom duties to such rates, thereby delivering a fatal blow to an economy that depends on import of raw materials and durable goods? Imagine increasing the number of ministries and agencies on getting into power, and now promising to implement the 12 year old Steve Oronsaye Report to reduce them. Then, promise not to reduce the 1.5 million civil servants, making you wonder how costs can be cut without cutting the labour force? A 20% cut in cost will result in about 300,000 job losses which the economy can’t afford now due to the high rate of unemployment. Unfortunately, the private sector that can increase employment is now being deprived of investment funds due to high interests rates.

The most painful part is the savings extracted from the poor being wasted on things like bonuses for politicians, or even worse as Tinubu awarded Chagoury his friend a N1 trillion contract to build an inappropriate coastal highway on the sea, while the Lagos-Calabar railway project signed by Jonathan but sabotaged by APC remains comatose. How can you claim to stop fuel subsidies due to corruption by institutional players, and then try to soften the death blow with palliatives paid through more corrupt avenues? No be Juju be that?

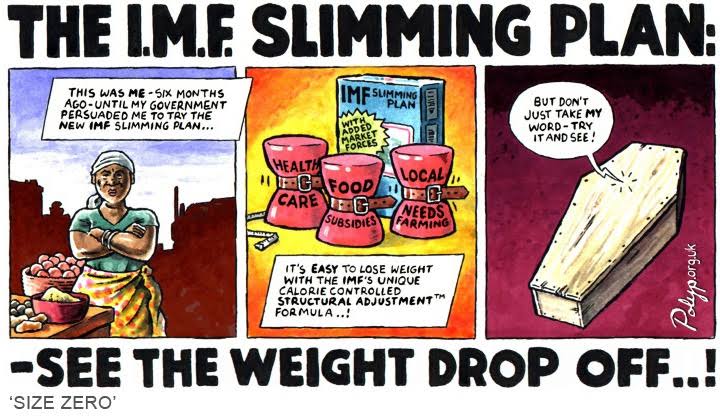

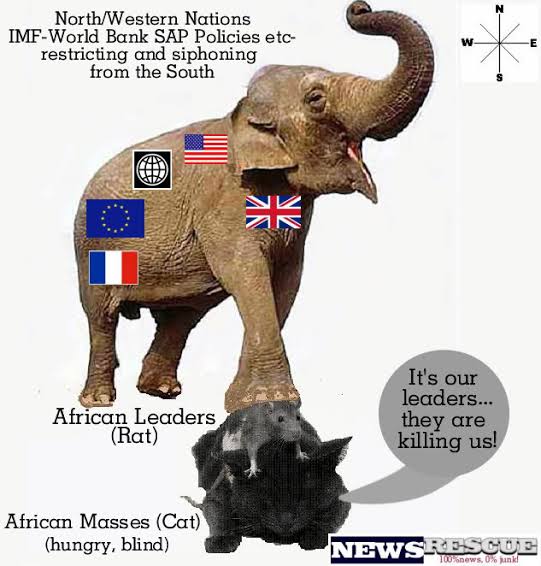

There are just too many inconsistencies in the governments economic policies that there appears to be more than meets the eye, ‘kin se oju lasan’. It appears he is under the spell of the witches and wizards of Bretton Woods, where IMF and World Bank were born, with a tint of African wizardry.

With all these Economic irrationalities, Psychoanalysts can only give the Nollywood advice of seeking traditional home remedy ‘te ese Ile bo’, but not of the spiritual type that will involve sacrifices, since Tinubu is already sacrificing the collective to the gods of hunger by outpricing us. Instead of sacrifices it is advised to take him back to his Afenifere home of making life more abundant, and beg his elders, the Agbagba, like Pa Adebanjo to perform exorcism, in a procedure called decoloniality that involves weaning off colonial and neocolonial influences, especially those of the village people in IMF/World Bank that cast a spell of outpricing on him, a spell of self destructiveness.

There is a sense of urgency because in the sixty six Black nations of Africa and Caribbean, where the IMF/World Bank cast the outpricing spell, all led to great economic and political destabilization, so we must act quickly before Omoyeni strips and runs into the market naked, afi ka wa nkan se si, ki aso to bo lara Omoyeni, ki Omoyeni ma ba rin ihoho woja! Kere ooo!